What is Rideshare Insurance?

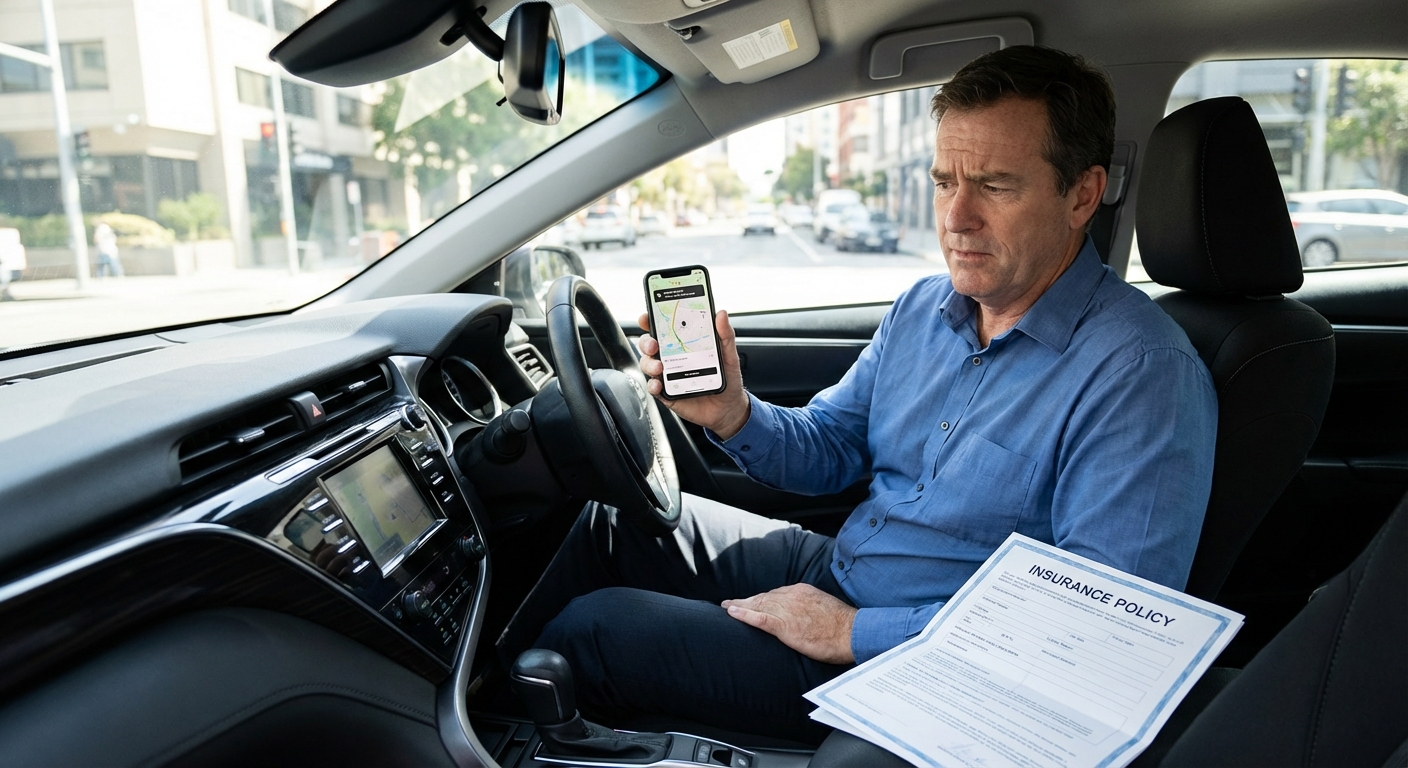

Rideshare insurance is specialized auto insurance coverage designed specifically for drivers who work with transportation network companies (TNCs) like Uber and Lyft. This coverage bridges the critical gap between your personal auto insurance policy and the commercial coverage provided by rideshare companies during different stages of your driving activity.

Personal auto insurance policies specifically exclude coverage when you're using your vehicle for commercial purposes—including rideshare driving. Without proper rideshare insurance for drivers, you could face devastating financial consequences if an accident occurs while you're working. Many drivers mistakenly believe their personal policy covers all their driving activities, but insurers can deny claims and even cancel policies if they discover unreported commercial use.

Rideshare insurance comes in two primary forms: endorsements (also called riders) added to your existing personal policy, or standalone commercial policies. Endorsements are significantly more affordable and provide comprehensive protection across all periods of rideshare activity. This specialized coverage typically costs between $15-30 per month—a small investment compared to the financial risk of driving uninsured.

The Three Periods of Rideshare Driving Coverage

Understanding the three distinct periods of rideshare driving is essential for comprehending your insurance needs. Each period represents a different stage of your work activity and comes with varying levels of coverage from both your personal insurer and the rideshare company.

Period 0: App Off (Personal Use)

Period 0 occurs when you're not logged into the rideshare app and using your vehicle for personal reasons. During this time, your standard personal auto insurance applies normally. You're covered by your personal policy's liability, collision, and comprehensive coverage just like any other driver. This is the only period when rideshare activity doesn't factor into your coverage at all.

Period 1: App On, Waiting for Requests

Period 1 begins the moment you turn on the rideshare app and become available to accept ride requests. This is where the most significant coverage gap exists. While you're waiting for a ride request, Uber and Lyft provide only contingent third-party liability coverage of $50,000 per person, $100,000 per accident for bodily injury, and $25,000-$30,000 for property damage.

This contingent coverage only applies if your personal insurance denies the claim—which it almost certainly will, since most personal policies exclude commercial activities. During Period 1, you have no collision or comprehensive coverage for damage to your own vehicle unless you have a rideshare endorsement. This gap leaves many drivers financially vulnerable during the time they spend waiting for rides.

Periods 2 & 3: Ride Accepted and Passenger in Vehicle

Periods 2 and 3 provide the most robust coverage from rideshare companies. Period 2 starts when you accept a ride request and are en route to pick up the passenger. Period 3 covers when the passenger is in your vehicle until they exit at their destination. During these periods, Uber and Lyft provide $1 million in third-party liability coverage for injuries and damages to others.

However, recent changes in some states have reduced protections. As of January 2026, California's SB 371 reduced uninsured/underinsured motorist (UM/UIM) coverage from $1 million to just $60,000 per person and $300,000 per accident during Periods 2 and 3. Rideshare companies also provide collision insurance and comprehensive coverage during these periods, but typically with a $1,000 or $2,500 deductible—much higher than most drivers carry on their personal policies.

Coverage Gaps and What Rideshare Drivers Actually Need

The most dangerous misconception among rideshare drivers is believing their personal auto insurance covers them while working. Personal policies contain clear exclusions for commercial activities, and insurers routinely investigate claims to identify rideshare usage. If discovered, they'll deny coverage and potentially cancel your policy entirely, leaving you without insurance for personal driving as well.

During Period 1, when you're logged into the app but haven't accepted a ride, the coverage gap is particularly severe. You have no physical damage coverage for your own vehicle, and the liability coverage provided by Uber and Lyft is minimal—far below what most financial advisors recommend. If you cause an accident while waiting for a ride request, you could face substantial out-of-pocket costs for both vehicle repairs and liability claims.

The deductible gap presents another significant concern. While rideshare companies provide collision and comprehensive coverage during Periods 2 and 3, their deductibles typically range from $1,000 to $2,500. If you carry a $500 deductible on your personal policy, you'll face unexpected costs when filing claims during active rides. Some rideshare insurance endorsements offer deductible reimbursement up to $2,500, effectively eliminating this financial burden.

What rideshare drivers actually need is continuous, seamless coverage across all three periods. A rideshare endorsement added to your personal policy extends your existing coverage—including your chosen liability limits, collision, comprehensive, and other protections—to cover all rideshare activity. This creates a single, unified insurance solution without coverage disputes or gaps.

Cost of Rideshare Insurance Endorsements

Rideshare insurance endorsements are surprisingly affordable, especially considering the financial protection they provide. Most major insurance companies charge between $15-30 per month to add rideshare coverage to an existing policy, though costs can range from as low as $6 per month to around $60 per month depending on various factors.

Several factors influence how much you'll pay for rideshare coverage:

| Factor | Impact on Cost |

|---|---|

| Driving record | Clean records qualify for lower rates; accidents and violations increase premiums significantly |

| Location | Urban areas with higher accident rates and crime typically cost more than rural or suburban locations |

| Vehicle value | More expensive vehicles cost more to insure due to higher repair and replacement costs |

| Usage frequency | Part-time drivers may qualify for lower rates than full-time rideshare professionals |

| Base premium | Your existing policy cost affects the endorsement price—higher base premiums mean higher endorsements |

State Farm rideshare endorsements typically increase premiums by 15-20%, with full coverage averaging $181 per month including the rideshare endorsement. Progressive offers some of the most competitive rates, with endorsements starting as low as $6 per month and full coverage averaging $163 per month. Allstate's "Ride for Hire" endorsement costs $5-10 monthly, while Geico's business use addition starts around $6 per month.

When comparing costs, it's essential to understand that rideshare endorsements add only $72-$360 annually to your insurance costs. Compare this to commercial auto insurance policies specifically designed for business use, which typically cost $1,200-$2,400 per year or more. For most part-time and even full-time rideshare drivers, endorsements provide the same essential protections at a fraction of the cost.

Best Insurance Companies Offering Rideshare Coverage

Not all insurance companies offer rideshare coverage, and those that do vary significantly in their offerings, coverage periods, and costs. Based on comprehensive analysis of coverage options, customer satisfaction ratings, and affordability, several companies stand out as top choices for rideshare drivers in 2026.

State Farm

State Farm consistently ranks as the best overall choice for rideshare insurance. The company offers coverage across all three periods of rideshare driving in all 50 states, with deductible reimbursement that helps offset the high deductibles imposed by TNCs. State Farm earned an A++ rating from AM Best and tops J.D. Power's customer satisfaction rankings for claims handling.

Average full coverage with rideshare endorsement costs $181 per month. State Farm's in-house claims handling and extensive agent network make it easy to get help when you need it most. The company's rideshare endorsement seamlessly extends your personal policy coverage to all periods of rideshare activity, eliminating coverage disputes and gaps.

Allstate

Allstate's "Ride for Hire" endorsement provides comprehensive coverage across all three periods, available in all states except New York. The company offers deductible reimbursement up to $2,500, which effectively eliminates the gap between your personal deductible and the TNC's higher deductible requirements during active rides.

With an A+ AM Best rating and strong mobile app ratings (4.1-4.8 stars), Allstate makes managing your policy convenient. Average full coverage costs $217 per month with the rideshare endorsement, and the endorsement itself typically adds just $5-10 monthly to existing policies. Learn more about choosing comprehensive auto insurance providers.

Progressive

Progressive ranks second largest among U.S. insurers and offers strong rideshare coverage that also extends to delivery drivers for services like DoorDash and Uber Eats. The company's rideshare endorsements start as low as $6 per month in some states, making it one of the most affordable options available.

Progressive provides excellent digital tools for managing your policy and tracking your coverage. Full coverage with rideshare endorsement averages around $163 per month. The company's willingness to cover both rideshare and delivery driving makes it particularly attractive for gig economy workers who perform multiple types of work.

Geico

Geico offers affordable rideshare coverage through its business use endorsement, with rates starting around $6 per month. While Geico provides solid basic coverage, it lacks some of the rideshare-specific features offered by State Farm and Allstate, such as dedicated deductible reimbursement programs.

Full coverage for Lyft drivers through Geico averages around $121 per month, making it one of the most budget-friendly options. The company's straightforward process for adding rideshare coverage and competitive pricing make it a strong choice for cost-conscious drivers.

Other Notable Options

Mercury Insurance offers comprehensive rideshare coverage at the lowest overall rates—approximately $0.90 per day for full coverage. However, Mercury operates only in select states, limiting availability. American Family provides the cheapest full coverage nationally at $161 per month but covers only Period 1 and operates in limited states like Arizona, Colorado, and others.

Rideshare Insurance vs Commercial Auto Insurance

Understanding the distinction between rideshare insurance endorsements and commercial auto insurance is crucial for making the right coverage decision. While both protect you during business use of your vehicle, they differ significantly in scope, cost, and intended use cases.

Rideshare insurance endorsements are designed specifically for drivers who use their personal vehicles for both personal and rideshare purposes. These endorsements attach to your existing personal auto policy and extend coverage to include your rideshare activities. They're ideal for part-time or even full-time rideshare drivers who also use their vehicles for personal transportation, errands, and family activities.

Commercial auto insurance, by contrast, is a standalone business policy designed for vehicles used primarily or exclusively for commercial purposes. Businesses that own fleets of vehicles, delivery companies, or professional drivers who work for multiple TNCs simultaneously typically need commercial policies. These policies provide broader protection but come with significantly higher premiums.

Key Differences

| Feature | Rideshare Endorsement | Commercial Auto Insurance |

|---|---|---|

| Annual Cost | $72-$360 ($6-30/month) | $1,200-$2,400+ |

| Coverage Scope | Personal + rideshare use | Primary business/commercial use |

| Policy Type | Added to personal policy | Standalone business policy |

| Best For | Part-time and full-time rideshare drivers | Fleet vehicles, multiple TNCs, delivery companies |

| Personal Use | Fully covered | May have limitations |

| Availability | Limited to participating insurers | Widely available from commercial carriers |

Most rideshare drivers benefit from endorsements rather than commercial policies. The cost savings are substantial—potentially $1,000 or more annually—while providing equivalent protection for rideshare activities. Commercial insurance makes sense only in specific situations: if you drive for multiple TNCs simultaneously that have conflicting insurance requirements, if you operate other types of commercial driving beyond rideshare work, or if your insurer doesn't offer rideshare endorsements.

Rideshare Insurance for Delivery Drivers

Delivery drivers for services like DoorDash, Uber Eats, Grubhub, and Instacart face similar insurance challenges as rideshare drivers, though requirements and coverage vary by company. Understanding these differences is essential for ensuring you're properly protected while making deliveries.

DoorDash requires drivers to maintain personal auto insurance meeting state minimum requirements. The company provides commercial auto insurance covering up to $1 million in third-party liability during active deliveries when you've accepted an order and are en route or completing the delivery. However, this coverage doesn't protect your vehicle or cover you when you're waiting for delivery requests with the app on.

Uber Eats provides similar coverage structure to Uber's rideshare platform. When you're online and available for deliveries, and when actively making deliveries, Uber Eats provides $1 million in liability coverage plus optional injury protection in most states. Like DoorDash, the gap coverage during Period 1 (app on, waiting) remains limited.

Instacart takes a different approach—the company provides no auto insurance coverage at all. Instacart drivers must supply their own insurance coverage for all driving activities related to deliveries. This makes adding commercial use or rideshare/delivery endorsements to your personal policy especially important for Instacart shoppers.

Many insurance companies that offer rideshare endorsements also extend coverage to delivery drivers. Progressive, in particular, advertises coverage for both rideshare and delivery work. State Farm, Allstate, and other major carriers typically include food delivery under their rideshare or commercial use endorsements, though you should verify specific coverage with your insurer.

The cost for delivery driver coverage typically matches rideshare endorsement pricing—$6-30 per month added to your personal policy. Some insurers may charge slightly different rates depending on whether you're doing passenger transport or delivery work, but the difference is usually minimal. Given that personal policies exclude commercial use, having proper coverage is essential to protect yourself from liability claims and vehicle damage costs.

Common Misconceptions About Personal Auto Policies and Rideshare Work

Many rideshare and delivery drivers operate under dangerous misconceptions about their insurance coverage. These misunderstandings can lead to devastating financial consequences when accidents occur. Understanding the reality behind these myths is crucial for protecting your financial future.

Myth 1: "My Personal Auto Insurance Covers Me While Driving for Uber/Lyft"

This is the most common and dangerous misconception. Personal auto insurance policies contain specific exclusions for commercial activities, including transporting passengers or goods for a fee. When you drive for Uber, Lyft, or delivery services, you're engaging in commercial activity that your personal policy explicitly doesn't cover. Insurers routinely investigate claims to identify commercial use, and they will deny coverage if they discover undisclosed rideshare or delivery driving.

Myth 2: "The Rideshare Company's Insurance is Enough"

While Uber and Lyft provide substantial insurance during Periods 2 and 3, significant gaps exist. During Period 1 (app on, waiting), you have minimal liability coverage and no physical damage protection for your vehicle. The high deductibles ($1,000-$2,500) during active rides also leave you vulnerable to unexpected costs. Relying solely on TNC coverage means accepting substantial financial risk.

Myth 3: "My Insurer Won't Find Out About My Rideshare Driving"

Insurance companies have sophisticated methods for identifying rideshare and delivery activities. They cross-reference claim locations and times with TNC data, review social media, and investigate inconsistencies in your claim details. When they discover undisclosed commercial use, they don't just deny the claim—they often cancel your entire policy, making it difficult and expensive to find coverage in the future.

Myth 4: "Rideshare Insurance is Too Expensive"

At $6-30 per month for most drivers, rideshare endorsements cost less than many people spend on coffee each week. Compared to the potential costs of an uninsured accident—which could include vehicle replacement ($10,000-$50,000), liability claims ($50,000-$1,000,000+), legal fees, and policy cancellation—the endorsement cost is minimal. The question isn't whether you can afford rideshare insurance; it's whether you can afford to drive without it.

Myth 5: "I Only Drive Occasionally, So I Don't Need Special Coverage"

Frequency doesn't matter when it comes to coverage exclusions. Whether you drive one hour per week or 40 hours, your personal policy excludes commercial use. A single accident while logged into a rideshare or delivery app can result in a denied claim and policy cancellation, regardless of how rarely you drive for these services.

Frequently Asked Questions About Rideshare Insurance

Do I really need rideshare insurance if I only drive occasionally?

Yes, you need rideshare insurance regardless of how frequently you drive for Uber, Lyft, or delivery services. Personal auto insurance policies contain commercial use exclusions that apply whether you drive one hour per week or full-time. Even a single accident while logged into a rideshare app can result in a denied claim, policy cancellation, and personal liability for all damages. The frequency of your driving doesn't change your coverage requirements or risks.

How much does rideshare insurance typically cost per month?

Rideshare insurance endorsements typically cost between $15-30 per month, though rates can range from as low as $6 to around $60 monthly depending on your location, driving record, vehicle value, and usage frequency. Companies like Progressive and Geico offer endorsements starting at $6 per month, while other carriers charge closer to $20-30 monthly. This represents a 15-20% increase over your base premium, which is significantly cheaper than commercial insurance at $100-200+ per month.

What's the difference between rideshare insurance and commercial auto insurance?

Rideshare insurance is an endorsement added to your personal auto policy that extends coverage to include your rideshare activities, costing $6-30 monthly. Commercial auto insurance is a standalone business policy designed for vehicles used primarily for commercial purposes, costing $100-200+ monthly or $1,200-$2,400+ annually. Most rideshare drivers benefit from endorsements due to lower costs and the ability to maintain coverage for both personal and rideshare use under a single policy.

Will my personal auto insurance cover me during any period of rideshare driving?

No, personal auto insurance policies specifically exclude coverage during all periods of rideshare activity, including when you're logged into the app but waiting for ride requests. Even though you're not actively transporting a passenger during Period 1, your personal policy considers this commercial availability and will deny coverage. Without a rideshare endorsement, you have no collision or comprehensive protection during Period 1, and your insurer may cancel your policy if they discover undisclosed rideshare activity.

Do delivery drivers for DoorDash and Uber Eats need rideshare insurance?

Yes, delivery drivers need specialized insurance coverage beyond standard personal auto policies. While DoorDash and Uber Eats provide $1 million in liability coverage during active deliveries, they offer minimal or no coverage during Period 1 when you're waiting for delivery requests. Personal auto policies exclude commercial activities including food delivery. Many insurers offer rideshare endorsements that also cover delivery driving, typically costing $6-30 monthly and providing comprehensive protection across all periods of delivery work.